Transportation infrastructure (interstate highways, roads, and bridges and capital for transit systems) in the United States is funded primarily by an indirect user fee, specifically at the Federal level by the 18.4 cents/gallon excise tax on gasoline and the 24.4-cent tax on diesel fuel. States have their own fuel taxes. These revenues go into the Federal Highway Trust Fund or a similar state fund. The gas tax at the Federal level is not indexed to inflation, and since the last time it was raised nearly 20 years ago in 1993, its purchasing power has substantially declined.

Given the continued increases in fuel efficiency and the introduction of alternatively fueled vehicles, including hybrid and electric vehicles, the revenue generated will continue to decline significantly. In fact, it already has.

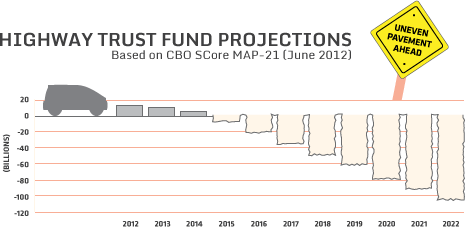

- Since 2008, gas tax expenditures have exceeded receipts requiring a transfer of $34.5 billion from the general fund to the Highway Trust Fund to pay the bills.

- With increasing gas prices and greater use of energy efficient and alternative fuel vehicles, and the need to maintain at least the current levels of expenditure, the Highway account of the Highway Trust Fund will be insolvent in early 2015 according to the Congressional Budget Office (CBO).

- According to one recent study (American Road and Transportation Builders Association), the new CAFÉ standards will result in the loss of more than $65 billion in the Highway Trust Fund dollars between 2017 and 2023. A similar study was recently released by Congressional Budget Office.

The effort to build a user-pays principle to infrastructure improvements—coupled with the search for more stable revenue sources—has led to calls for a mileage-based user fee (MBUF) approach. The biggest merit of MBUF is that it brings us much closer to a user-pay system, by charging drivers directly for the miles they travel and the resulting wear and tear on the roads. It also addresses the declining revenue value of the gas tax.